The Gambit: Unpacking the War Tariff as a Political Weapon

The recent imposition of tariffs by the United States on Indian goods marks a significant new chapter in global trade diplomacy. This action is not a conventional economic dispute but a deliberate act of economic coercion and a profound test of India’s sovereign decision-making. The core argument is that these tariffs are a self-inflicted wound for the U.S. and, paradoxically, a potential catalyst for India’s long-term strategic transformation. By linking economic demands to foreign policy, the U.S. has revealed its hand, reframing the issue from a commercial disagreement to a contest of strategic autonomy.

The U.S. tariff offensive began with a series of decisive, incremental steps. On July 31, 2025, President Donald Trump announced a 25% tariff on all exports from India to the United States. This was quickly followed by an additional 25% tariff on specific exports on August 6, resulting in a steep 50% penal tariff on Indian goods. The U.S. administration offered two primary justifications for this aggressive move. The first was India’s steadfast refusal to open its agricultural market to tariff-free U.S. imports, particularly dairy products. The second, overtly political, was India’s continued purchase of Russian crude oil despite U.S. economic sanctions. This explicit linkage between trade policy and geopolitical alignment demonstrates that the tariffs are a tool to force India to align its foreign policy with the U.S. agenda. This approach moves the discussion from market competition to a demand for political capitulation.

The U.S. has attempted to justify these measures under the guise of reciprocity for what it labels non-reciprocal trade relationships and persistent trade deficits. This justification is a flimsy facade. The U.S. is not seeking reciprocity; it is seeking submission. The ICRIER Policy Brief reveals a "puzzling methodology" behind the tariffs that is not about correcting imbalances but about imposing penalties under the pretence of fair trade. The formula used by the Trump administration divides a country’s trade surplus with the U.S. by its total exports, then halves the result to determine the additional tariff rate. This approach effectively targets countries with the largest trade surpluses, imposing penalties under the disguise of fair trade.

While the U.S. has branded India a ‘tariff king’ for its high import duties, a closer look at the data reveals that India’s stance is a necessary defence against an unequal global trade system. According to the WTO, India's average agricultural tariffs are 39%, which is 7.8 times higher than the 5% average tariff that the U.S. imposes on Indian farm exports. However, this disparity is a response to the uneven playing field created by wealthy nations. The U.S., for instance, spends over $48 billion annually on domestic farm support, including crop insurance subsidies, price guarantees, and export-linked supports disguised as food aid. This allows U.S. farmers, who are highly mechanised, to sell their goods abroad at or below cost without a loss of income. In contrast, India's support for its agricultural sector is less than 5% of its production value, well below the 10% limit allowed for developing countries under WTO rules. Opening the Indian market to such heavily subsidised competition would devastate the livelihoods of millions of Indian farmers, 46% of whom rely on agriculture for their livelihood. India’s high tariffs are therefore not an act of unfair protectionism but a defensive mechanism to safeguard its fragile rural economy. This is not about a consistent application of trade policy but is an arbitrary tool used to punish those with whom it has the largest trade deficits. A critical aspect of the U.S. policy is its disproportionate application, which offers India a relative advantage despite the tariffs.

The Boomerang Effect: A Self-Inflicted Wound for the U.S.

The U.S. tariff policy is not only an act of economic coercion against India but also a high-stakes gamble with significant negative consequences for its own economy. The imposition of tariffs on imports acts as a supply shock, driving up costs for intermediate and consumer goods and triggering a boomerang effect of inflation. The SBI Research report quantifies this impact, estimating that the tariffs could push up U.S. CPI inflation by 2.0% in the short run and 1.2% in the long run after market adjustments. This inflationary pressure is projected to cost the average U.S. household approximately $2,400 in the short term, with low-income families bearing a disproportionately higher burden.

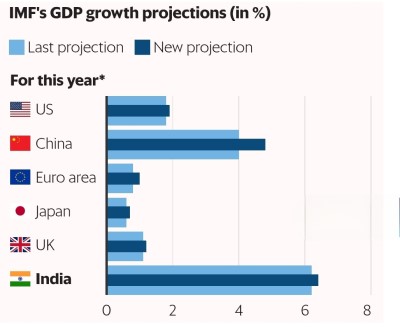

Beyond inflation, the U.S. economy faces a serious risk of stagflation, a scenario of high inflation coupled with low growth. U.S. GDP is projected to slow to 1.5% in 2025, a sharp decline from 2.8% in 2024, as the tariff shock takes its toll. The historical precedent for such a policy is dire. A direct comparison can be drawn to the Smoot-Hawley Tariff Act of 1930, which triggered a wave of retaliatory tariffs, collapsed global trade, and exacerbated the Great Depression. Economic history demonstrates that tariffs create deadweight loss, distort markets, and foster unsustainable artificial industries that collapse when protective barriers are eventually removed.

Furthermore, the tariffs expose a deeper vulnerability in the U.S. economy: its reliance on key Indian products. The U.S. depends on India for nearly 47% of its pharmaceutical needs, particularly in life-saving oncology drugs and antibiotics. If tariffs were to be expanded to this sector, it would not only raise prices but could also lead to critical drug shortages for American citizens. The political motivations behind the tariffs are also apparent. The SBI report notes that President Trump’s approval ratings had fallen to a low of 37% just six months into his second term, with a particularly steep decline among independents. This suggests that the tariffs may not be a well-reasoned economic policy but a high-stakes political gamble designed to boost domestic support by scapegoating foreign nations.

The Impact on India: Modest on GDP, Severe on Sectors

Despite the aggressive U.S. stance, the overall impact on India’s macroeconomic growth is expected to be modest and manageable. India’s economy is too large and diversified for one nation’s policy to derail its trajectory. Fitch Ratings, for instance, has affirmed India’s credit rating and forecasts a robust GDP growth of 6.5% for FY26, a rate that is unchanged from the previous year and well above the global average of 2.2%.4 The Global Trade Research Initiative (GTRI) projects that in a worst-case scenario, India’s GDP growth could slow by 0.9 percentage points, a headwind that the Indian economy is well-positioned to absorb.

The tariffs, however, have created a strategic shock with a severe, concentrated impact on specific sectors and their workers. The U.S. has imposed a 50% tariff on a significant portion of Indian exports, specifically targeting $60.2 billion worth of goods, which represents 66% of India’s total exports to the U.S. This is expected to have a devastating effect on labour-intensive industries. The pain is not an end but a powerful catalyst for India’s strategic pivot toward resilience and diversification. Labour-intensive sectors like textiles, gems and jewellery, and seafood are the most affected, but instead of capitulating, the Indian industry is responding with resolve and foresight.

India's Strategic Diversification Amidst U.S. Tariffs

(Sector | U.S. Policy & Impact | India's Strategic Response)

Gems & Jewellery

U.S. retailers demand 25-30% discounts, causing paused consignments and slumping demand. The industry faces potential losses and job risks.

Exporters are exploring new markets in Europe and the Middle East, with some firms shifting operations to Dubai. The industry is also pivoting to high-value products such as designer jewellery to retain competitiveness.

Textiles & Apparel

Indian goods have become up to 31% more expensive than rivals, leading to an anticipated 70% reduction in export volumes. India is capitalising on the PLI scheme and aiming to reposition its sector to be design-led, not just cost-based, with a focus on man-madefibress (MMF,) which dominate global demand.

Seafood (Shrimp)

A 50% tariff on top of existing duties brings the total to 60%, posing an existential threat to shrimp exports. The industry is focusing on tapping new markets and developing high-value products such as sustainable seafood to mitigate the impact.

Overall Exports

A GTRI report projects a 43% decline in U.S.-bound exports, which represents a short-term blow.

India is strategically targeting 50 nations in West Asia and Africa to reduce over-reliance on the U.S. market. The government is encouraging exporters to leverage new e-commerce platforms and B2B portals to bypass large US buyers.

Source: GTRI 2, American Bazaar Online, The Economic Times, ICRIER

The data reveals a stark contrast between a manageable macro-level impact and a severe sectoral impact. While the overall GDP may not be significantly derailed, certain industries will bear the brunt of the shock, leading to genuine hardship in key export hubs. However, India's strategic response is not one of panic but of long-term planning, seeking to transform this short-term setback into an opportunity for greater resilience and self-reliance.

India’s Strategic Response: A Path of Resolve, Not Retaliation

India’s response to the U.S. tariffs is defined by a strategic resolve rather than a purely retaliatory approach. The government’s stance, articulated by Prime Minister Modi, is that India will not sign any trade deal that compromises its farmers, dairy industry, or strategic autonomy. This position is not merely political posturing but is rooted in historical lessons and a deep understanding of India’s economic sensitivities.

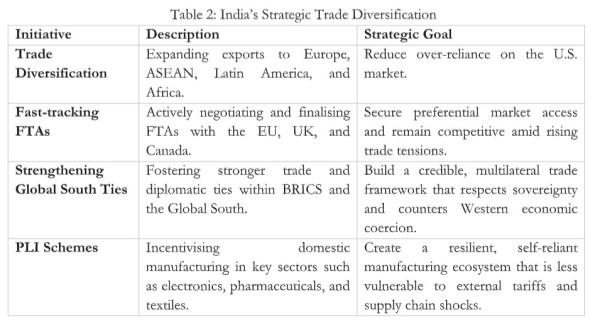

To mitigate the impact of the tariffs and build long-term resilience, India is actively pursuing a strategy of diversification over dependence. The nation is expanding its export destinations to new geographies such as Europe, ASEAN, Latin America, and Africa. This push is supported by the fast-tracking of Free Trade Agreements (FTAs) with key partners such as the EU and the UK, which are expected to provide preferential market access and reduce India's reliance on the U.S. Furthermore, India is strengthening its ties with the Global South and the BRICS partnership, which offer a credible alternative to the Western-centric trade order by respecting mutual sovereignty and fostering a multipolar world.

The tariffs have also served as a powerful validation of India’s long-term economic vision and proactive policies. The government’s Production Linked Incentive (PLI) scheme, which was launched to promote domestic manufacturing, is now more critical than ever. The PLI scheme is successfully fostering a resilient, self-reliant manufacturing ecosystem that is less vulnerable to external pressures. The scheme’s success is already evident, with electronics production surging by 146% and India transitioning from a net importer to a net exporter of bulk drugs. This demonstrates that India is no longer just the back office of the world but is becoming the factory, lab, and launchpad of the future.

India’s Strategic Trade Diversification

Source: India’s Stand Tall Amid Unjust U.S. Tariffs, The Economic Times, PIB

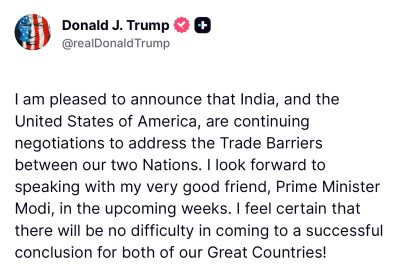

In the face of these challenges, India’s approach is not purely defensive. The Indian government has adopted a nuanced diplomatic and economic strategy. While taking a firm stand on sovereignty and domestic interests, it has also shown a willingness to engage in bilateral talks. The suggestion that India could rationalise outlier tariffs on certain goods, such as walnuts and berries, where it does not have a strong domestic production base, demonstrates a confident and mature approach to global trade. This shows that India is willing to engage in a balanced, two-way relationship, but only on its own terms and in a way that protects its core national interests.

The Inevitable Rise: A Glimpse into the Future

The U.S. tariffs are more than an economic disruption. They are a political signal, challenging India’s right to independent policymaking. While the immediate impact on sectors such as textiles, seafood, and gems is severe, the macroeconomic damage is limited, and the strategic response, already in motion, is long-term.

India has chosen not to retaliate impulsively, but to respond with clarity. It is accelerating FTAs with the EU and UK, boosting its PLI schemes, and actively targeting alternative export markets in Africa, West Asia, and Latin America. The focus is clear: reduce dependency, increase competitiveness, and build lasting resilience.

This journey is already well underway. India’s economy, which was the world’s 11th largest just a decade ago, is now the 5th largest and is on an unstoppable path to becoming one of the top three economies globally in the coming years. This growth is projected to be sustained at 6.5% annually, a rate well above the global average, fuelled by strong public capital expenditure and a pickup in private investment. The government’s strategic focus is on sustainable and inclusive growth, leveraging India’s demographic dividend and its rising middle class. The plan includes initiatives to build greenfield industrial smart cities, develop new national industrial corridors, and remove archaic laws to ensure a smooth business environment. India is also rapidly becoming a technology powerhouse, with 34% of the world’s STEM graduates and a vibrant startup ecosystem, aiming to become a leader in AI, quantum technology, and digital manufacturing.

India is moving forward on its own terms. We are not asking for permission. We are writing its own script. To those who expected a retreat, India has offered resolve. Not bluster, but balance. Not appeasement, but ambition.

As Atal Bihari Vajpayeeji has said:

काल के कपाल पर लिखता- मिटाता हूं,गीत नया गाता हूं।

Bharat, too, is writing, not in fear, but in foresight. Amid disruption, it finds direction. Amid pressure, it finds purpose.

Bharat will trade. Bharat will grow. And Bharat Mata will rise, sovereign, fearless, and unshaken.

References

‘Strategic shock’: Donald Trump’s tariffs to hit 66% of India’s exports to US; China, Vietnam set to gain, accessed on August 26, 2025, https://timesofindia.

The price of protectionism: Understanding the economic tradeoffs of tariffs | State Street, accessed on August 26, 2025, https://www.statestreet.com/

World Economy to Slow Sharply in Wake of US Tariff Shock- International Banker, accessed on August 26, 2025, https://internationalbanker.

How Protectionism Hurts Consumers and the Economy - The W&L Spectator, accessed on August 26, 2025, https://www.wluspectator.com/

Fitch affirms India at 'BBB-' with stable outlook, says tariff impact on GDP will be ‘modest’, accessed on August 26, 2025, https://economictimes.

Fitch Forecasts India’s GDP Growth At 6.5% For FY26, Affirms ‘BBB-‘ Rating Amid Solid Growth | News9 - YouTube, accessed on August 26, 2025, https://www.youtube.com/watch?

How India’s export sectors are getting impacted by 50% US tariff - The New Indian Express, accessed on August 26, 2025, https://www.newindianexpress.

U.S. tariff impact: India sees Asia’s biggest earnings downgrades - The Hindu, accessed on August 26, 2025, https://www.thehindu.com/

Trump’s 50% tariff shock for India to hit soon – what it means for growth, jobs, and hardest-hit sectors, accessed on August 26, 2025, https://economictimes.

How U.S. tariffs threaten Indian exports from textiles to jewellery - The American Bazaar, accessed on August 26, 2025, https://americanbazaaronline.

Indian exporters should diversify into newer geographies to beat US tariff hit, accessed on August 26, 2025, https://timesofindia.

PLI Scheme: Powering India's Industrial Renaissance - PIB, accessed on August 26, 2025, https://www.pib.gov.in/

India must navigate US tariffs through global trade diversification: Geoff Dennis, accessed on August 26, 2025, https://economictimes.

India Vision 2047: risks and opportunities, accessed on August 26, 2025, https://www.controlrisks.com/

India @2047: Transforming India into a Tech-Driven Economy | Bain & Company, accessed on August 26, 2025, https://www.bain.com/insights/

India Opportunity - Invest India, accessed on August 26, 2025, https://www.investindia.gov.